Banked is building a global payments network that uses modern banking rails.

Banked is building a global payments network that uses modern banking rails.

Banked's Pay by Bank solution bypasses traditional payment rails and settles payments in real-time directly between customer accounts. This is far cheaper - resulting in a 90% reduction in transaction costs - and, since customer bank details are no longer shared, more secure, leading to a 96% reduction in fraud.

Banked was launched with the introduction of Open Banking regulation in 2018. In the four years since, Banked has established itself as a leading open banking player globally, having secured contracts with Bank of America, Citi Bank, and National Australian Bank, to name a few.

- United Kingdom

- Fintech

- Series A

Artificial allows specialty insurers and brokers to algorithmically underwrite risks.

Artificial allows specialty insurers and brokers to algorithmically underwrite risks.

The $880bn specialty insurance market exists to underwrite risks that are non-homogenous, complex and often tailored to the end client (for instance insuring the Ever Given, which blocked the Suez Canal in 2021). Insurers typically choose to share these risks between them, using ‘syndicates’ to manage the overall cost.

The process for underwriting these risks remains stubbornly bureaucratic and manual, with each party in the value chain using archaic IT systems that are unable to communicate with one another.

Artificial has built technology that allows insurers and brokers to digitise their underwriting processes. A proprietary insurance programming language acts as a single horizontal data layer and extracts unstructured data, standardises it and provides context. This data is then shared between different parties through APIs, eliminating the need to integrate into core IT systems, which significantly lower the hurdle for adoption. Finally, Artificial built the algorithmic underwriting technology required to automatically approve or decline risk. It codifies underwriting appetite and provides the tools necessary to manage the risk/return of the insurance book.

- United Kingdom

- Insurtech

- Series A

Barte is a B2B payments and cash flow management platform for SMEs, helping them to simplify complex payment processes and unlock growth.

Barte is a B2B payments and cash flow management platform for SMEs, helping them to simplify complex payment processes and unlock growth.

Working capital management is one of the biggest headaches for Latin American SMEs due to outdated payments infrastructure and little access to capital. Entrepreneurs in the region commonly struggle with low transaction approval rates, manual processes and poor visibility, constraining cash flow even for viable businesses.

Based in Brazil, Barte gives Latin American SMEs access to working capital financing, making it easier for them to manage their finances. Barte has shown strong traction since launch, reaching a user base of thousands of customers in its first year in business.

- LATAM

- Fintech

- Seed

Rivero offers solutions for banks to manage fraud recovery, payments disputes and scheme compliance.

Rivero is a payment technology provider that specializes in streamlining operations within the highly regulated payments industry. The company offers unique SaaS solutions for fraud recovery, dispute management, and payment scheme compliance to enable banks to manage complex payment operations.

Their flagship products, Kajo and Amiko, set them apart in the industry. Kajo is their exclusive solution for payment scheme compliance, minimizing risks and efforts for payment network licensees. Amiko revolutionizes fraud recovery and dispute processes by digitalizing them, thus aiding issuing banks in efficient management and achieving more than 50% in cost savings, while also enhancing consumer protection.

In just three years since its go-to-market, Rivero has secured partnerships with over 20 well-established financial institutions, ranging from issuing banks to acquiring banks and payment processors. In 2022, Rivero became the first Swiss Fintech to be selected for the Visa Fintech Partner Connect program, an initiative that provides Visa’s clients with access to a selection of best-in-class and trusted technology partners.

- Switzerland

- Fintech

- Series A

Superhog is an insurance provider for the short term rental market.

Superhog is an insurance provider and risk management platform for the global short term property rental market.

Short-term property rentals have seen their popularity grow rapidly in recent years. They now account for 30% of the overall hospitality market. This in turn has led to huge growth in the need for tools to help manage these properties, from booking software, to marketing tools, to insurance.

Superhog offers insurance and verification services to property managers, hosts and guests. It has verified more than 500,000 bookings, protected more than 75,000 bookings, and operates in 25 countries.

- United Kingdom

- Insurtech

- Series A

Personalised employee benefits and engagement platform.

Happl offers a personalised employee benefits and engagement platform.

Happl is the first fully connected and integrated platform, weaving together a broad range of benefits in one intuitive environment. These encompass health insurance, group benefits, financial assistance, learning and development opportunities, gifting, and a network of retailers offering discounts and rewards. Through its AI-powered benefits assistant, Happl is able to offer a personalised journey and thus target employees with benefits they truly care about.

In addition to enhancing employee satisfaction, Happl also introduces direct cost savings for employers. With its cloud-first platform and flexible API integration, Happl streamlines the exchange of data between its benefits platform and the employer's accounting and payroll systems. This automation significantly reduces the workload for administration and finance teams.

The company shipped the first version of its product in 2023, after graduating from Y-Combinator. It has since expanded successfully across both the SME and enterprise segments in Europe.

- United Kingdom

- Fintech

- Insurtech

- SaaS

- Seed

Ori Industries (Ori) provides software that makes edge computing possible.

Ori Industries (Ori) provides software that makes edge computing possible.

Edge computing is the next generation of Cloud computing. Both have the same core offering: making remote computing resources available on-demand. The difference lays in the delivery. Cloud computing transmits information over vast distances to centralised datacentres. Edge computing uses software to connect local servers, devices and nodes, thereby creating a decentralised cloud which is physically closer to the end-user. Reducing distance saves milliseconds in processing time, which is crucial to the growing number of technologies that require real-time data such as factory automation, self-driving cars and the internet of things.

Ori creates the software that makes edge computing possible. Clients include both the supply side – owners of local nodes who would like to increase utilisation rates – and the demand side, users of edge computing.

Ori’s client base ranges from financial companies to telecom operators. Telcos own a large proportion of available edge nodes in the world and are keen to improve utilisation rates. Demand-wise, Telcos see an opportunity to gain an entire new customer base through edge computing. For example, the 5.6 billion IoT devices that exist today.

- United Kingdom

- Big data & Analytics

- Seed

Pomelo Pay allows merchants to take payments from anyone, in any location, at low cost without installing hardware.

Pomelo Pay is a Fintech payment company focused on South-East Asia. Its technology allows local merchants to take payments from anyone, in any location (physical or digital), at a low cost and without installing hardware. Pomelo provides integrations with 30+ payment networks globally, including Alipay and WeChat.

Pomelo Pay launched in The Maldives in 2019, signing an exclusive contract with the Bank of Maldives. Since then, it has expanded to Singapore, Thailand, Sri Lanka and Vietnam. It has already onboarded thousands of merchant, processing billions in volume.

- South-East Asia

- Fintech

- Series A

MagicOrange gives enterprises granular insight into their IT spending.

As companies increasingly rely on technology and software, IT spending has become a meaningful (and growing) part of corporate costs. However, CFOs lack the tools to properly understand and attribute IT spending.

MagicOrange allows CFOs to trace IT and other shared services costs and assign them to specific business units, activities and products. It enables management to make data-driven decisions on spending and take control of their budgets. It can also provide detailed analysis of profitability and potential M&A synergies.

MagicOrange has already signed up 20+ blue chip clients, each with annual IT spending in excess of $75m annually, and has established sales partnerships with leading consultants such as Accenture, EY and Microsoft.

- United Kingdom

- Fintech

- SaaS

- Series A

Sprinque is building an end-to-end payments platform for B2B marketplaces.

Sprinque is building an end-to-end payments platform for B2B marketplaces.

The B2B e-commerce market is now 5x the size of the online B2C market. However, the existing offline and manual processes B2B merchants rely on are inadequate for managing risk and serving hundreds of online buyers across multiple geographies.

Sprinque is a first mover in the digital B2B payment space. It provides a checkout solution to online merchants and marketplaces, offering flexibility in payment options and a frictionless checkout experience. Merchants can offer Pay by Invoice with payment terms at scale whilst enjoying enhanced risk control.

Sprinque's buyer coverage includes the majority of Europe to enable frictionless cross-border e-commerce. It is initially targeting sellers in the Netherlands, Spain and Germany, but is looking to expand to other countries quickly.

- Netherlands

- Fintech

- Seed

Payflow is an earned wage access platform. It enables employers to offer salary advances cheaply and easily to their employees.

Payflow is an earned wage access platform. It enables employers to offer salary advances cheaply and easily to their employees.

Payflow integrates with payroll systems and fully automates the end-to-end process of providing salary advances. Employees receive an app through which they can view available balances and have flexible access to earned wages.

Payflow provides the cash advance to the employee and is repaid automatically through the payroll distribution at the end of the month, freeing the employer of the working capital and administrative burden that comes with early salary access. The amount available to employees is dependent of the number of days the employee has worked when requesting the advance, and the limits agreed with the employer.

Payflow does not take fees from the employee, nor does it charge interest on salary advances. Instead, it asks employers to pay a fixed monthly fee per employee for the service. A straightforward offering, at a low cost, for a highly appreciated corporate benefit.

Payflow went live in Spain 2021, where it found strong demand for its offering. It has since expanded into Latin America, where Payflow is live in Chile, Peru and Colombia. The company was accepted into Y-Combinator and completed the accelerator program in early 2022.

- LATAM

- Spain

- Fintech

- Seed

Landvault is the largest builder in the metaverse, allowing brands to enter virtual worlds.

Landvault is the largest builder in the metaverse, allowing brands to enter virtual worlds.

Previously known as Admix, Landvault provides end-to-end metaverse solutions. It sources virtual land, builds projects and supplies the technology to monetise and grow a business in the metaverse.

Landvault is positioned at the forefront of the fast-growing Web3. It is already the largest builder in Decentraland and the Sandbox, two of the largest virtual worlds.

- United Kingdom

- Web3

- Series B

Banxware is an embedded finance company that enables any company to offer financial services.

Banxware is an embedded finance company that enables any company to offer financial services.

Banxware enables companies to offer lending and financing services to other companies, such as their suppliers, merchants or partners. Banxware can for example enable an e-commerce platform to provide speedy working capital loans to merchants that sell through its platform.

By combining historical and live sales data, open banking data and digital accounting data, Banxware is able to provide an instant credit profile of the merchant and monitor creditworthiness in real time. The e-commerce platform can then decide to offer a loan based on this data. This loan can be financed through the balance sheet of the e-commerce platform or through a banking partner of Banxware.

- Germany

- Fintech

- Series A

Apaleo is a cloud-based property management system (PMS) for hotels and serviced apartments.

Apaleo is a cloud-based property management system (PMS) for hotels and serviced apartments.

The world of travel and hospitality has changed significantly in recent years with the rise of players like AirBnB and Booking.com. However, hotels have been slow to adapt to changing consumer needs, thanks in part to the outdated technology most use. Legacy PMS systems are expensive, difficult to install and do not integrate easily with modern software solutions.

Apaleo has built the next generation PMS with flexibility and adaptability in mind. It easily integrates with hundreds of other software tools and apps thanks to its API-first build, while its cloud-based approach makes it easy to update or launch new functionality. Apaleo provides the core functionality needed to manage a hotel such as inventory management, pricing and reservations, while also offering clients access to dozens of additional third-party apps through the Apaleo app store. This approach allows hotel operators to create the technology stack that is ideal for their specific needs.

Apaleo’s product is 100% self-serve, and the team has onboarded hundreds of hotel operators across 15 countries in the past 2 years, including in the US and Asia, without having a local presence or ever needing to sell ‘managed services’. The platform benefits from powerful network effects – the more hotels it signs up, the more valuable it becomes to app developers and vice versa.

- Germany

- Marketplaces

- SaaS

- Series A

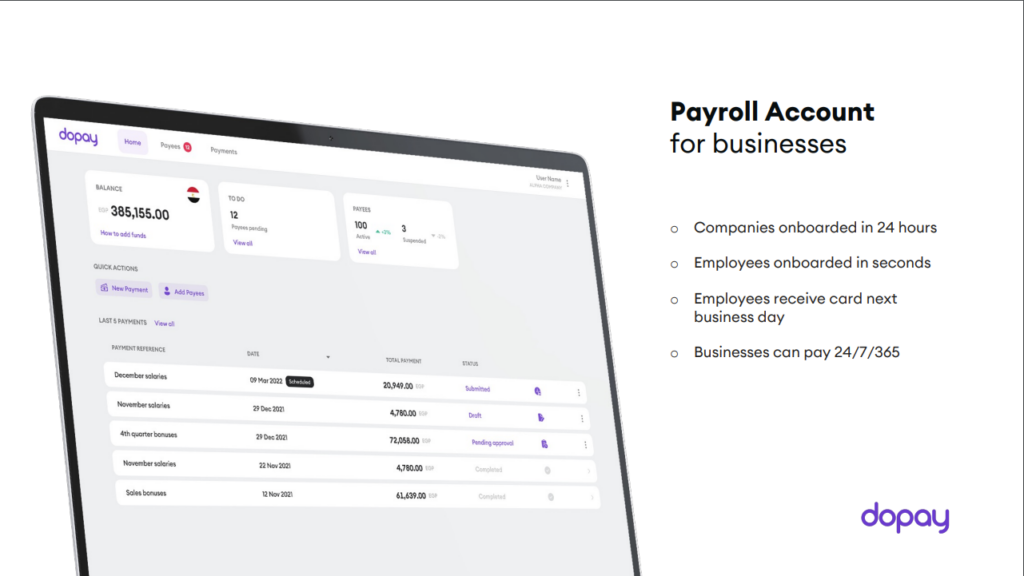

Dopay is addressing one of the most significant Fintech opportunities in the market today, banking the unbanked.

Dopay is addressing one of the most significant Fintech opportunities in the market today, banking the unbanked

Dopay is currently focused on Egypt, where 70m people do not have a bank account, despite having a job and a regular income. Dopay operates an innovative B2B2C model, whereby it provides digital banking and payroll services to companies, who then automatically onboard their employees as Dopay clients.

Dopay’s corporate customers range from local SMEs to international conglomerates such as McDonalds. Dopay currently earns a small fee on the total payroll processed. Because Dopay becomes the primary (and often only) bank account of its clients, there are numerous opportunities to grow revenues by cross-selling financial products.

- MENA

- Fintech

- Series A

OutFund is a digital SME lender.

OutFund is a digital SME lender. It has reinvented the SME lending process, from application to collection:

SMEs apply digitally in minutes and receive a decision within hours or days. The credit approval process is highly automated, with Outfund plugging directly into a company’s bank accounts, payment systems, accounting systems, and commerce systems to collect data. This provides a holistic, unfiltered, real-time, and continuous picture of the company and its performance. Capital is repaid daily, out of company revenues. This allows borrowers to pay more on good days and less on slower days.

Outfund is already a market leader in the UK, Spain and Australia. More recently, it has added Belgium, the Netherlands and Germany. Outfund is known for its strong risk management, and has one of the lowest default rates in the industry.

- United Kingdom

- Fintech

- Series A

Finway is a financial management platform for SMBs, offering expense management, invoice processing, flexible payment and more.

Finway is a financial management platform for SMBs, offering expense management, invoice processing, flexible payment and more.

Small and medium-sized companies make up the backbone of the European economy, but they lack the tools to run their finances in a centralised, digital way. The market for SMB finance tools is very fragmented, leading many companies to rely on inefficient manual processes for payments, reconciliation and accounting.

Finway makes it easy for companies to integrate all the different areas of their financial operations. It allows them to manage their spending, budgeting, payment approval workflows, accounting and pre-accounting.

- Germany

- Fintech

- Series A

Mobietrain is a microlearning platform for frontline and deskless workers.

Mobietrain is a microlearning platform for frontline and deskless workers.

Digital training is a huge market but remains focused on white-collar office workers. Deskless or frontline workers, such as people who work in stores, are woefully underserved. Even though these workers are often the only touch point between a company and its customers, and more training tends to result in higher sales and an improved public perception of a company.

Mobietrain has developed a platform that allows employers to deliver training to frontline staff in short 5-15 minute sessions, delivered via a mobile app. It uses gamification techniques to improve engagement, resulting in double the number of employees completing their training compared to other tools. This translates into a higher skilled and more engaged workforce, which in turns leads to improved productivity, more job satisfaction, better retention and less absenteeism.

Mobietrain is a SaaS company rather than a services company. It provides technology and the clients create the content using the tools on the platform.

- Belgium

- SaaS

- Series B

Shippr is a B2B last-mile delivery platform.

Shippr is a B2B last-mile delivery platform. Businesses, like consumers, are increasingly shopping online. The B2B e-commerce market is already four times larger than the B2C e-commerce market, creating a need for reliable delivery infrastructure to serve changing logistics needs.

Shippr operates a platform that connects businesses with professional B2B couriers. These couriers are often specialised, providing refrigerated trucks to deliver sushi to restaurants and supermarkets, for example.

Shippr's platform allows businesses to select pick-up or delivery slots, their required method of transport and any additional services required. The platform uses sophisticated matching algorithms to optimise routes, reducing cost and carbon emissions, and provides granular, real time data insights.

- Belgium

- Marketplaces

- Series A

Tangent Works automatically builds and maintains predictive models in real-time.

Tangent Works automatically builds and maintains predictive models in real-time.

As big data proliferates, the ability to use available data to make more accurate and timely forecasts becomes increasingly essential to competitiveness. Predictive models can help companies grow sales, save costs and optimise operations. Tangent Works automates the mundane and time-consuming process of model building. Customers simply feed (time series) data into the TW modeller, which then automatically builds and maintains predictive models.

Tangent Works sells its technology through Enterprise OEMs, who include the technology as a feature on their platform, as well as through specialist consultants who use it to create specific solutions for certain industries and companies. This go-to-market approach allows Tangent Works to focus on its technology (and license revenues) rather than services, which enhances the scalability of the business.

- Belgium

- Big data & Analytics

- Series A

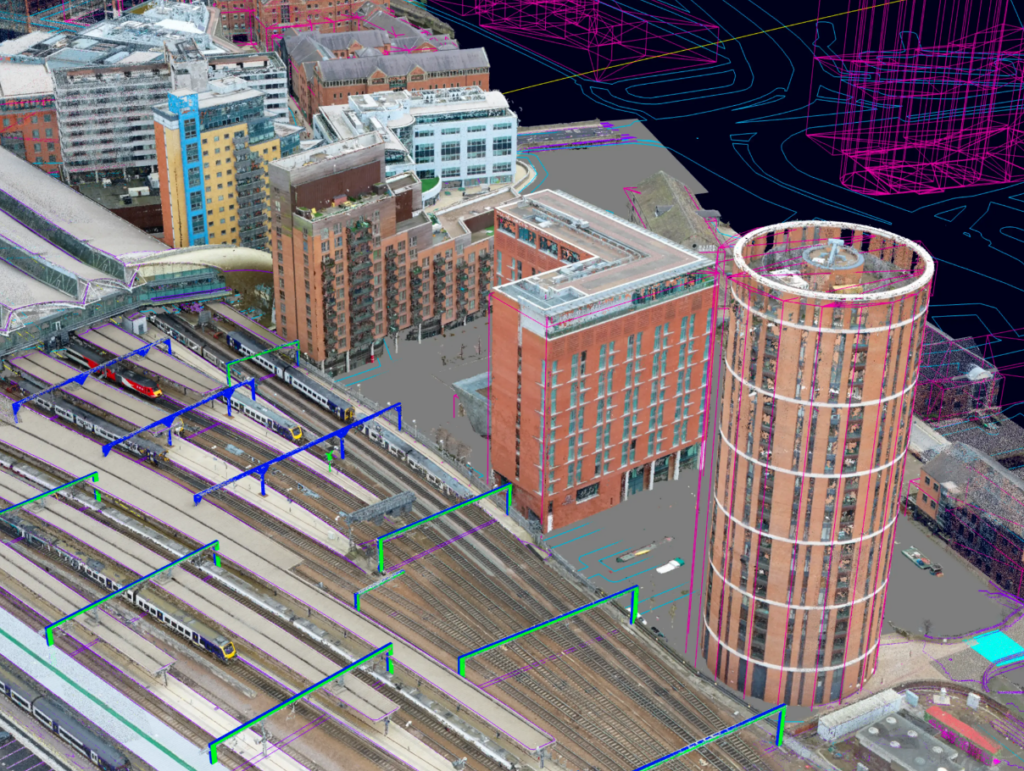

SenSat creates 3D digital models of real-world environments with engineering-grade accuracy to transform surveying work.

SenSat creates 3D digital models of real-world environments with engineering-grade accuracy to transform surveying work.

Construction is one of the least digitised industries. Large projects typically come in over-budget and behind schedule. Companies operate on thin margins, and labour productivity has not kept up with the broader economy.

SenSat is changing the status quo by creating cloud-based, 3D models of construction sites using autonomous mapping drones. These models allow construction firms to replace physical surveying with digital measurements, delivering results up to 400x faster and 10x cheaper.

Furthermore, SenSat’s Mapp technology acts as a platform which can be used to aggregate all available topographical and design data in one place (not just SenSat data). Clients can upload their own Lidar data, engineering designs, or create links to live feedback from IoT devices on the ground (Internet of Things). Through Mapp, construction projects can be managed without visiting the site daily and decision making is transformed from manual and physical to digital and automated.

- United Kingdom

- Big data & Analytics

- Series B

Blockpit is a tax calculation and reporting solution for digital assets.

Blockpit is a tax calculation and reporting solution for digital assets.

Digital assets are rapidly gaining share of wallet with investors, with over 100m people trading them actively. Governments are taking notice, and many are starting to tax capital gains on digital assets.

Calculating capital gains is far more complex for digital assets than for traditional assets such as stock-market-listed equities. Digital asset investors typically use a wide range of different wallets and exchanges and each purchase includes several steps which are separately taxable.

Blockpit makes tax calculations easy by automatically retracing and consolidating transactions across different wallets and exchanges. It extracts data through APIs, then uses it to connect the dots and calculate tax liabilities based on the user’s jurisdiction. Blockpit already provides fully compliant crypto tax reports for Austria, France, Germany, Spain, Switzerland and the USA.

In addition to tax calculation and reporting, Blockpit provides anti-money-laundering (AML) compliance tools. Financial institutions accepting monetary gains from cryptocurrency trades require proof-of-origin to comply with AML directives. Having a tool that automatically retraces transactions throughout history is a game changer.

- Austria

- Web3

- Series A

In3 allows customers to spread the payment of purchased products interest-free over 3 instalments.

In3 allows customers to spread the payment of purchased products interest-free over 3 instalments.

Consumer adoption of instalment-based payments, also referred to as Buy Now Pay Later (BNPL) has been rising rapidly, now accounting for 25% of ecommerce payments in pioneering Sweden, 20% in Germany and 10% in Belgium. BNPL companies earn fees by charging the merchant rather than the consumer. Merchants fund these fees by not having to pay credit card fees (typically 2-4%) and by benefiting from improved sales metrics. The average BNPL consumer has a 20% higher conversion rate at checkout and a 40% larger basket value.

In3 differentiates themselves from other players with a very mature approach to BNPL. Firstly, In3 partners with payment service providers (PSPs) – companies that facilitate payments on behalf of merchants - to roll out its offering, rather than targeting merchants directly. Secondly, In3 can offer BNPL at checkout in physical stores as well as online, opening up a market that is far larger than e-commerce alone. Thirdly, In3 has an exceptional risk management track record, resulting in write offs and fraud rates substantially below industry averages.

- Netherlands

- Fintech

- Series B

Adhara uses blockchain technology to optimise international payments.

Adhara uses blockchain technology to optimise international payments.

A globalised world relies on global money flows. Financial institutions send huge sums back and forth across different countries, jurisdictions and subsidiaries. Unfortunately, processes are not standardized and differ from bank to bank and country to country, with different payment cut-off times, settlement times, processes, and reconciliation procedures.

The result is a complex and costly global payment system. Many cross-border payments require manual intervention and transactions take hours or days to settle, resulting in substantial liquidity management costs which easily amount to $100m+ for a large bank per year.

Blockchain and digital currencies allow for these costs to come down. Today’s global payment system works by sending ‘messages’ that require reconciliation by third parties (e.g. SWIFT). By replacing messages with digital currencies, capital can be transferred directly between users on a blockchain without the need for reconciliation.

Adhara provides the infrastructure to facilitate blockchain-based international payments. It can be used by both central banks and commercial banks, internally and externally, charging a fee for the use of its infrastructure.

- United Kingdom

- Fintech

- Series A

Scroll provides smart financing to homeowners by digitising the second lien mortgage market.

Scroll provides smart financing to homeowners by digitising the second lien mortgage market.

The value of residential real estate in the UK now exceeds £8tn, of which £6.5trn is home equity. For many people, a significant part of their wealth is tied into their house, but its equity value remains unavailable until the house is sold.

Historically, people sometimes refinanced their mortgage to access small sums of equity, e.g. to repair a roof or make a home more energy efficient. However, that becomes an expensive exercise in a rising interest rate environment, where the interest on the total mortgage goes up following refinancing.

The solution to this is a second lien mortgage. Rather than refinancing the primary mortgage, house owners can take out a small second mortgage, which is subordinated to the first mortgage. The loan is still asset-backed, which allows for a much lower cost of financing compared to unsecured personal loans.

Scroll has fully digitised the second lien mortgage process. From application to approval and collection, the process is 100% digital and automated, allowing people to receive flexible financing fast and with minimum effort. Scroll initially targets the buy-to-let market, specifically landlords with a household income above £50k, moderate to low LTVs, looking for £25k-£500k, repayable over 3-25 years.

- United Kingdom

- Fintech

- Seed