Payments over the internet are nothing new. Legend has it the first online purchase was made in 1994, when a Pizza Hut in San Diego began accepting orders through their website. Since then, it has been a rich vein for technological innovation.

The first real revolution in online payments started in December 1998, when Paypal began launched. The product ended up becoming so popular with eBay users that the auction platform acquired it for $1.5bn in 2002.

The next milestone came in 2009 with Stripe, which enabled any website or online shop to accept digital payments simply by integrating three lines of code. The ease of integration solved a huge headache for software developers and went viral among the developer community. Stripe is currently used by 2 million merchants, processes hundreds of billions in payments per year, and was valued at $95bn in its last funding round.

Several other payment innovators have grown to be multi-billion-dollar companies over the past decade. Companies such as Adyen, Square, GoCardless, Mollie and more. All of these companies have two things in common:

- They focus on B2C payments

- Their innovation lies in making it easier to reach customers, but they still mostly rely on the traditional settlement infrastructure (known as the payment ‘rails’)

Only recently have we started seeing innovation in the way payments are processed. Open Banking now allows for a direct settlement of transactions, bypassing the 40-year-old payment rails and thereby saving substantial costs. This is where we see companies like Banked emerging.

Payments have come a long way. Hearing about how these purchases took place in the early days sounds hopelessly antiquated: most transactions were settled by mailing paper cheques, which took on average 10 days to clear.

However, in spite of the changes in consumer payments in recent years, most of the B2B payment system still operates like consumer payments did in 1994. Processes are slow to complete, often paper-based, and lead to huge amounts of wasted time and money.

So far, the online payments revolution has passed B2B payments by. Most businesses still rely on stubbornly manual processes. Even Amazon Marketplace settles 80% of its payments through manual offline invoicing, and some data indicate that half of all B2B transactions still rely on paper cheques.

This won’t last, we believe there is massive opportunity for innovation in B2B payments, and there are signs that the sector is reaching a tipping point.

B2B payments are far bigger than B2C

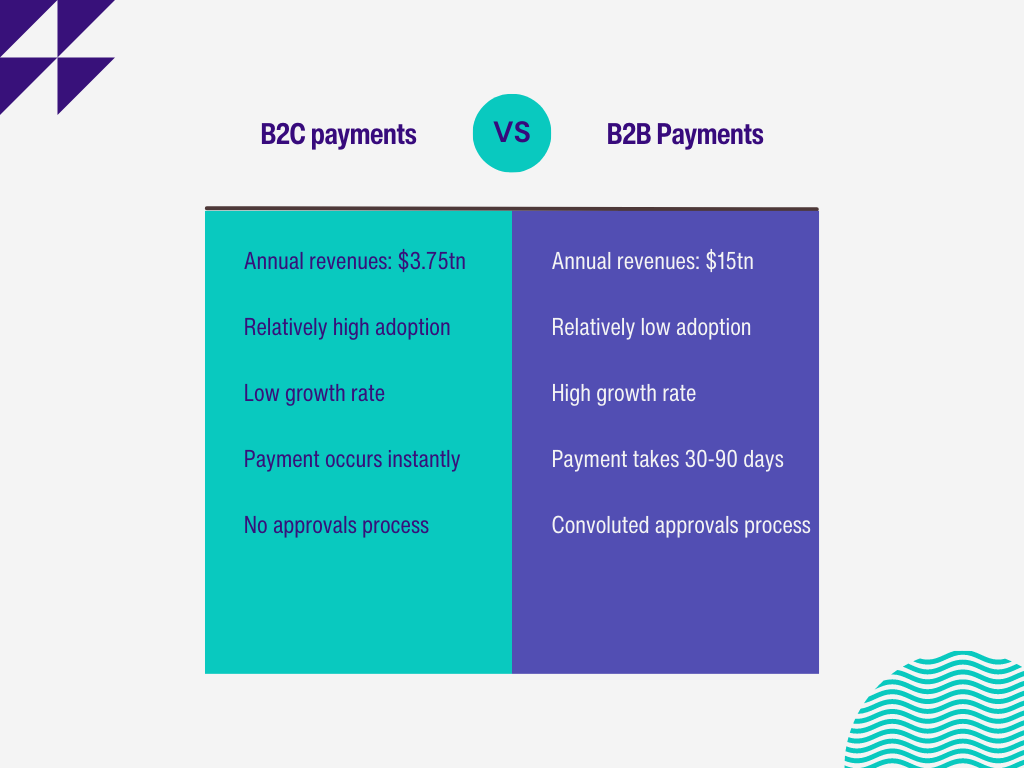

It’s easy to underestimate just how much bigger B2B payments are than B2C. B2B e-commerce, for example, has relatively low penetration compared to B2C, but the annual revenues in B2B e-commerce now sit at $15tn, four times the size of B2C at $3.75tn.

What’s more, there are signs that the time is right for a huge increase in adoption.

Spurred on by the pandemic, businesses have increasingly turned towards new methods of payment. The latest data from the UK shows that the faster payments network and other forms of remote banking became the most popular payment method among businesses for the first time in 2021 – the most recent period with data available – accounting for 39% of payments and replacing BACS direct credit.

Growth is forecast to continue, helped along by the ongoing development of open banking. Startups like Banked are driving the change here, giving businesses, banks and individuals a way to harness open banking technology to process payments in real time.

It’s not hard to see why businesses are keen for new ways to send and receive money. Slow, complex processes put huge pressure on companies. Research by Marqeta shows 55% of SMBs in the UK are owed between £10k and £75k, with 35% needing those funds to prevent falling into insolvency.

Startups are stepping in to solve this need. Companies like Sprinque are seeing strong demand for flexible B2B payment solutions, while earlier this year Tranch raised $100m in debt and equity to provide “B2B BNPL”.

Legacy players have taken notice too. Just last month Lloyds Bank launched an instant B2B payment tool called PayMe.

Where we go from here

Reinventing B2B payments isn’t going to be easy, of course. There are many reasons why adoption has lagged.

B2C buyers make small, relatively homogenous purchases of one or a few items, they are happy to pay up-front and typically favour convenience – hence the rapid shift from cash towards mobile payments.

B2B buyers, on the other hand, typically make enormous orders of hundreds or thousands of items, with complex buying processes involving several stakeholders and specialized needs. They also rarely, if ever, pay upfront, preferring to pay invoices on 30, 60 or 90-day terms after receipt of their goods.

But the need for change is clear, and the opportunity is massive. The steady growth of newer payment methods shows businesses are ready for something new, and startups can provide it.

We believe things are just getting started, so in the coming months, we’ll be publishing articles and research on where the world of B2B payments goes next. To stay up-to-date, follow us on Linkedin here.

If you’re building in the space, we’d love to hear from you. Please reach out to us here.