6 Degrees Capital partner Thibault D’Hondt originally published this primer on Institutional DeFi on his personal Substack. You can find it here.

The decentralised finance (DeFi) industry is going through a crucible moment. The spectacular failures of some of the most prominent crypto investors and institutions brought about a sense of fear, fragility and, hopefully, humility. Contagion is still crippling the market, thus forcing the sector to find answers on how its open standards can be approached differently, with more security and protection for its participants. To make matters even more challenging, investors have become less incentivised to seek crypto’s juicy returns as the era of ultra-low interest rates has come to an end. More favourable yields can be found in safer traditional markets, hence the bar for further innovation in the Web3 ecosystem has been raised.

In this context, it is little surprise that the crypto industry has started to explore a closer connection to the traditional financial ecosystem. A growing number of blockchain projects are now turning their focus towards so-called real world assets (RWAs), i.e. hard assets including treasury bills, stocks, traditional credit and real estate. The idea here is that these assets are introduced on-chain via the process of tokenization. This makes these assets more accessible for Web3 participants and thus offer an alternative to the highly correlated yields within the digital asset economy.

Importantly, the growing interest in tokenization of assets is not limited to Web3 investors. Building full-scale financial services that leverage tokenization also unlocks significant cost savings for traditional financial institutions as autonomous applications reduce middle- and back-office operations whilst minimising counterparty risk. In other words, tokenizing securities is not just about bringing traditional financial assets to the crypto ecosystem; it’s also about bringing DeFi to traditional financial assets. Indeed, every major financial institution today is experimenting with tokenization of assets, from JP Morgan tokenizing cash deposits to KKR tokenizing its latest healthcare fund (cf. here and here). BlackRock’s CEO Larry Fink goes as far as claiming that tokenization is key to the future of capital markets. The fact that blockchain infrastructure is starting to get scalable is catalysing this growing interest as well as the observation that the Web3 financial protocols (e.g. for lending and market making) have held up well during extreme market events.

However, for institutions to further explore the power of DeFi, appropriate guardrails and permissions are required to mitigate both operational and regulatory risks. Introducing new trust properties could enable DeFi to find global reach instead of limiting itself to innovation for crypto by crypto. This upgraded view on DeFi has now been coined Institutional DeFi. For a precise definition, I resort to the explanation provided by Oliver Wyman in a joint paper with DBS, JP Morgan and SBI Digital Asset Holdings:

“We define Institutional DeFi as the application of DeFi protocols to tokenized real-world assets, combined with appropriate safeguards to ensure financial integrity, regulatory compliance, and customer protection.”

It is important to note that Institutional DeFi does not refer to institutional players participating in DeFi. Rather, it points towards a more controlled use of DeFi innovation so that every investor (both institutional and retail) can leverage its benefits whilst enjoying stronger regulatory protection. The autonomous protocols will operate with stricter rules and procedures as regulators and financial institutions increasingly look at these with a similar lens as traditional banking operations. The challenge is in adding a layer of safeguards for compliance without creating walled gardens and thus going back to the status quo. I am aware that the use of the word ‘decentralised’ is somewhat contentious here. As Chris Burniske puts it, “DeFi” may well turn out to be a phase and phrase to denote mostly early experiments of how finance could run on blockchains (“on-chain finance”).

When done correctly, Institutional DeFi unlocks broader adoption and allows for a tighter integration between crypto and traditional financial markets, thus removing the need to treat them as two separate environments. In this research, I will go deeper into the process of tokenization, why it is relevant for both crypto and traditional finance, where I expect strong demand, and what I believe the winning innovators look like.

Tokenization and its benefits

Tokenization is a method of converting the ownership right from a real-world asset into a digital unit, or a token, which can be recorded, stored, moved and traded on a blockchain. Each token represents (a fraction) of the underlying asset. As such, tokenization promises to completely change the concept of ownership. Various assets and financial instruments can be represented by tokens, including stocks, bonds, private credit, private equity, shares in funds & trusts, real estate, collectibles, insurance and carbon credits.

The following BCG chart gives a detailed overview of the tokenization process flow, from deal origination and token issuance to secondary trading and asset redemption.

This process flow reveals the most important benefits of issuing assets on-chain, starting with increased efficiency & lower risk. Our current financial infrastructure usually takes place in silos which leads to friction, settlement delays and high costs related to post-trade reconciliation. Tokenized assets, in contrast, can be delivered simultaneously with payment (“atomic settlement”), resulting in strong finality guarantees.

Moreover, programmable logic enabled by smart contracts allows for automation of multi-party operational activities and thus reduces middle-or-back-office overhead. For example, compliance rules can be encoded in the smart contract, thus automating enforcement around who can hold the token and how it can be transferred. The smart contract may also facilitate post-trade activities like reporting, liquidations for collateral and dividend & coupon distributions (e.g. cashflow waterfalls and debt tranching built natively into smart contracts).

Finally, smart-contracts unlock a new method of price discovery, as they can facilitate buy and sell orders in a self-executing manner. These so-called automated market makers automatically calculate what the investors get and at what price rather than relying on a market maker to quote a price or to match a buyer and a seller. This could prove to be particularly useful in book building processes.

In sum, there are plenty of ways where tokenization helps to reduce costs in capital markets. One HSBC study showed a reduction of up to 90% in the cost of bond issuance using blockchain, as over 2,000 tasks could be automated.

The second benefit relates to public blockchains being auditable in real-time. Strong transparency opens up the ability to verify the quality of asset collateral and system risk exposure. Indeed, public block explorers (e.g., Etherscan) and data dashboards (e.g., Dune, Nansen) arm every participant with sophisticated tools to study on-chain activity and flag risks. Furthermore, the source code of the DeFi apps itself is open-source and can be reviewed and questioned by anyone.

Third, as tokenization reduces participation thresholds, issuers can expose certain asset classes to a wider audience and thus see increased liquidity. Investors face more flexibility, choice, and potentially secondary liquidity. Asset classes which take most advantage here include private equity, private credit, corporate bonds, real estate and a broad range of so-called alternative assets.

Lastly, tokenization allows for a new financial paradigm characterised by collaboration and interoperability. The open and composable nature of DeFi protocols (i.e., their ability to interact with one another) unlocks seamless collaboration between different financial applications, ultimately enabling a more globally integrated finance industry.

For example, the blockchain’s transparency allows investors to access their asset holdings through any of the hundreds of wallet applications out there in one centralised overview.

Since lending protocols can ‘talk’ to your wallet (with user consent), one can get competitive rates from various providers in no-time. This stands in sharp contrast to the current process, where borrowers need to retrieve their asset information from a range of different service providers and submit this information to any potential lender individually.

After obtaining the loan, the lending protocol also enjoys a real-time overview of your assets whilst collateralization is automated through the smart contract (effectively serving as an escrow account).

Another example relates to swapping of assets. As assets now share a common settlement layer, securities from different asset classes can be exchanged without friction. E.g., swapping a corporate bond for a stock, bitcoin for (a share in) a house, etc. Put differently, tokenization of assets unlocks the opportunity to create “all-to-all” markets.

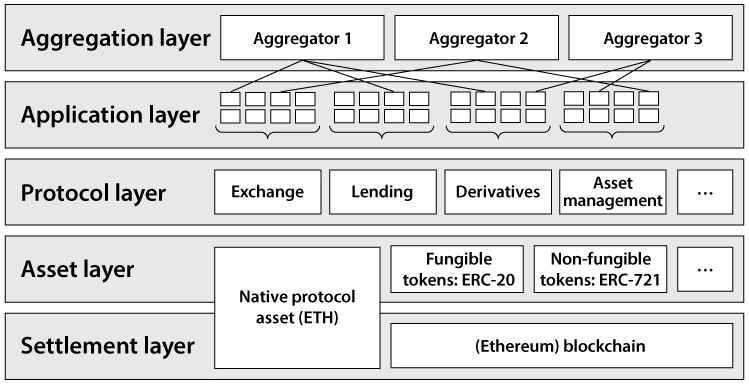

The picture below presents a good visualisation of DeFi’s multi-layered architecture starting from one and the same settlement layer, as well as the potential innovation following from its composable and permissionless nature.

Tokenization flavours

The process of tokenization is not binary. Unfortunately, most tokenization platforms to date simply create tokens which represent the economic value of the underlying asset. The token holder is not really entitled to the underlying asset itself and thus runs into trouble if the tokenization provider defaults. In other words, the tokenization platform adds another layer of counterparty risk, eliminating many of the reduced risk benefits stipulated above. True or native tokenization, in contrast, is achieved when the underlying asset is issued directly on-chain, meaning that the token is recognised as a bearer asset. This implies that the blockchain itself serves as the official share register. The investors are the custodians of their own shares, though they could outsource this to a third party.

Jurisdictions like Switzerland and Liechtenstein already have regulation in place that recognise digital assets as bearer assets. In France and beyond, Société Générale has adopted the CAST framework, a hybrid between using the underlying public blockchain as settlement whilst keeping an off-chain register. We are likely several years away for most securities to become natively digital, however, we can still achieve the benefits of tokenization in a trust-minimised way in cases where physical asset certificates prevail (e.g., when tokenizing a treasury bill or public stock). In such instances, the assets are usually placed in custody to ensure that the tokens are backed 1-1 by these assets. Safe tokenization requires that the token holder could show up at the custodian and redeem its asset without any third party involved (not even the tokenization platform / token issuer): there is an obligation agreement that prevents the redemption process from being subject to any solvency procedure. To achieve such an outcome, a token validator or trust anchor needs to be introduced (e.g., a Big4 auditor) and the agreements & compliance between the different parties involved should be encoded into the token protocol. Below is an example for the tokenization of a public stock.

Source: SwarmX Prospectus

For DeFi to become institutionalised, the tokenization process needs to be at arm’s length with any kind of risk possible. Therefore, it needs to to be as trustless and as self-reliable as possible. As such, true tokenisation brings us closest to the definition of Institutional DeFi, whilst staying aligned with the trust minimization ethos of the crypto community.

Where is the demand?

We will continue to see regulators, financial institutions and investors pushing start-ups and protocols to implement stronger guardrails to unlock mainstream adoption of digital assets and digitised securities. This includes stronger requirements when it comes to assessing financial crime, verifying identity, and reducing counterparty risk.

The ultimate ambition is for Institutional DeFi to blur the boundaries between the crypto and TradFi ecosystems we face today. Nonetheless, adoption of tokenized securities will occur at a different pace and this idealised (perhaps utopian?) view of both ecosystems meeting in the middle will take years to play out.

Web3 participants have a higher risk appetite, move faster, and are desperately looking for real-world use cases to onboard the next generation of Web3 participants. Traditional financial markets, in contrast, are highly risk averse, even more so after a string of spectacular blow-ups that has forced regulators to tighten controls harder than ever. They keep a close eye on innovative break-throughs and increasingly experiment with those propositions that unlock most value.

Demand from Web3

Whereas crypto-focused DeFi once offered high (yet unsustainable) returns in an era of ultra-low interest rates, the tables have turned. Yields in the traditional financial system (e.g. +4.5% from US treasuries) are now higher than the yields available in the crypto industry (e.g., 4.5% from ETH staking and a mere 1% from DeFi collateralized lending). Add to this that most crypto assets are highly correlated and you understand why crypto projects are urgently attempting to get their hands on hard assets like treasuries and stocks.

Looking at the crypto ecosystem more broadly, there are currently ca. $135B of outstanding stablecoins. Today’s market turmoil forces Web3 participants to hold higher reserves of cash (stablecoins) and other hard assets, however, there are very few options available for the latter. Any estimate of the size of the stablecoin market in several years from here is highly speculative, but surely some issuers will reap a large amount of minting fees when a share of this volume can be invested in tokenized real-world assets.

In fact, the stablecoin issuers themselves understand very well that it makes little sense to hold a large amount of dollars when risk-free treasuries pay +4%. Over $33B of the total stablecoins outstanding are in USDC, which is issued by Circle and backed ca. 75% by US Treasuries (with the remainder in cash). In other words, Circle enjoys a good income on your stablecoin holdings, whilst you are faced by the cost of inflation. None of the major stablecoin issuers share some of the underlying reserve interest revenue with their users.

Interest in RWAs took a further leap forward in 2022 when Maker altered its collateralization strategy. Maker is one of the dominant lending platforms in the crypto ecosystem and issuer of the $5B stablecoin DAI. The value of DAI is backed by collateralized digital assets from borrowers, and, increasingly, by traditional financial securities (RWAs). Last year, Maker’s exposure to RWAs grew from $17 million to $640 million. In an end-of-year review, it said it had begun a transition away from exposure to crypto-backed lending and allocated $400M into short-term treasuries and $100M into investment-grade corporate bonds. On March 7th, the company indicated it is planning to add another $750M in US treasuries.

Maker – RWA

Another use case showing the explosion in demand for RWAs can be found in the private credit market. About $4.3B across >1,500 loans has been originated on-chain, led by companies like Goldfinch, Credix, Maple Finance and Centrifuge. Interest has cooled off in the last few months, but the numbers remain significant.

Source: https://www.rwa.xyz/

The example of private credit is particularly interesting as usually this concerns credit products launched by seasoned investors from the traditional financial markets who are looking for additional liquidity on-chain. For example, a private credit investor like Apollo would spin up a special purpose vehicle to invest in consumer credit propositions in Southeast-Asia and take a junior position in this vehicle.

By tokenizing this debt structure, it can source additional capital from Web3 investors, who will assume a senior position in the pool. Whilst I am not yet convinced whether protocols should be inviting Web3 investors (particularly retail) to participate in such complicated debt instruments, the surge in interest definitely indicates that investors are desperately looking for hard assets. In addition, this use case also adds further evidence to the idea that Institutional DeFi will gradually merge traditional and Web3 investors in one and the same ecosystem.

Some of the innovators mentioned above already go much further than just private credit. For example, on Centrifuge investors can participate in pools for revenue-based financing, real estate, carbon offsets, and more. I am also expecting centralised exchanges to make a move on the RWA front. Just like Robinhood and Revolut have expanded their investment universe to crypto, I do not see why these exchanges would not aim to become the go-to investment broker for investors. To ensure a single interoperable environment for their clients, the logical choice would be to offer such securities in tokenized format.

Finally, I imagine some readers have started to wonder why investors would not just convert their digital asset holdings into USD and buy hard assets in the traditional market. The answer simply is that this introduces friction and costs, whilst investors would no longer enjoy any of the tokenisation benefits discussed earlier (particularly interoperability and composability). A large number of DAOs and investors would rather keep their assets in the ecosystem and take advantage of its open nature. Moreover, many traditional financial instruments remain rather inaccessible for a broad range of investors if they are not fractionalised in the first place. The private credit application above is a good example, but the same holds true for private equity, real estate, corporate bonds, etc. This brings us to the potential demand stemming from traditional finance …

Demand from TradFi

It is impossible to provide an exhaustive overview of demand from traditional retail and institutional investors for tokenized securities. There are simply too many different securities and use cases to list them all. Here’s an excerpt from Citi’s latest Global Perspectives and Solutions report:

Tokenizing financial and real-world assets could be the “killer use-case” that blockchain needs to drive a breakthrough, with trillions of dollars worth of securities by the end of the decade. Almost anything of value can be tokenized.

Citi forecasts that up to $4 trillion in tokenized digital securities and up to $5 trillion of central bank digital currency could be circulating in major economies by 2030, half of which could be linked to distributed ledger technology. Of course, the benefits of tokenization vary across the different asset classes considered. For example, lowering the entry barrier for participation is most important in asset classes like private equity, real estate and corporate bonds. I believe tokenization will allow the private banks of the future to offer highly curated portfolios in a cost efficient way and with the benefit of a secondary market. For cash, stocks and treasury bonds, the benefits from atomic settlement, interoperability and composability are more important than simply fractionalisation.

With major investment banks all expanding their digital issuance plans in 2023, the business case to support new issuance is being demonstrated at a market-wide level. We are clearly approaching an inflection point for tokenization, further evidenced by a number of projects listed below (not at all an exhaustive list).

| Use case / project | Participants | Celebrated benefits |

| Bond issuance | EIB, Goldman Sachs, Santander, Société Générale | Reduction in balance sheet risk for institutional and retail subscribers to new issuance. Settlement risks for issuers. arrangers and investors are all eliminated. |

| Bond issuance | HSBC, IDB / BBVA, SG Forge | HSBC identified over 2,000 tasks that could be automated throughout the bond issuance cycle, not only eliminating costs and risks, but also creating important new capacity. Corporate actions such as coupon payments can and should be entirely automated. |

| Bond issuance | BIS, Hong Kong Monetary Authority | By centralising and automating investor KYC, investor confirmations, final allocations and listing, they consolidated an order-book process down from 40 manually reconciled primary order books (at each distributing bank) and enabled book closing in a single day. |

| Asset swaps (bonds for deposits) | Monetary Authority of Singapore, JP Morgan, DBS Bank and Marketnode, | Preventing the formation of walled gardens in digital exchanges, reducing market fragmentation. Addressing market manipulation and risks. |

| Wholesale payments | Santander, Fnality, Natwest, Adhara | An early working example of how DLT-based payment systems will facilitate intraday liquidity savings, end-to-end repurchase agreements, and interbank intraday FX swaps. |

| Private equity | KKR, Securitize | Fractionalisation to enhance accessibility & liquidity. |

| Private equity | Apollo, Figure | Fractionalisation to enhance accessibility & liquidity. |

The investment perspective. What do the winners look like?

Based on this research, my conclusion is that the best innovators in this space are those who:

- Enjoy a deep understanding of capital markets and the regulatory landscape at the regional level

- Launch a token structure with minimal counterparty risk and maximal ownership for the token holder (“true tokenization”)

- Thrive in either origination or distribution of securities (and long-term in both).

Point 1 and 2 should be clear from the discussion above. Innovators who cut corners on the regulatory side might gain higher adoption in the short run, but they will undoubtedly hit a wall further down the line (e.g., do not sell securities, both directly and indirectly, to investors without running KYC and AML checks). Those operating in the grey zone will likely not see meaningful participation from large institutional players either.

Now let’s take a closer look at 3. Whilst the process of digitising assets on-chain is not trivial, the most challenging aspect relates to navigating the regulatory complexity and the policies between different parties involved rather than technological barriers. Therefore, I believe the strongest profits will go to those innovators that actually originate and/or distribute the assets instead of simply providing the middleware (e.g., tokenization, custody, clearing). However, as we are still early in the adoption journey, infrastructure providers could generate juicy profits in the interim (H/T to the research of Raysdale, Chong, and Venkatakrishnan).

A few areas where I see strong investment opportunities include:

-

- Absorbing safe and trusted RWAs with deep liquidity (e.g., treasury bills) into the crypto ecosystem, driven by DAOs and investors who want crypto-uncorrelated yield in their treasuries. Next to a clean regulatory set-up, one needs the right knowledge and relationships in crypto markets to distribute these securities in order to become a dominant market player. Partnerships with CEXs and large stablecoin issuers are the most plausible avenues to bootstrap demand. To lock in the end clients (investors), a full-stack approach is required where the token issuer also operates compliant trading infrastructure (using whitelisting of wallets) for exchanging such assets. In this way, the tokenization provider could earn both minting and trading fees. In the US, Ondo Finance seems to stand out, as it cleverly boosts the adoption of its securities with the introduction of a complementary and compliant lending marketplace (Flux Finance). I believe there will be new winners in other regions as dealing with local regulations is incredibly complex.

- As is the case in our current financial system, companies with strong edges in originating new or mispriced assets will continue to earn strong pricing power. For example, private credit in emerging markets requires strong underwriting capabilities, and the use of blockchain infrastructure does not change that. However, originators could leverage tokenization for better distribution and lowering the cost of post trade services. For the tokenization provider to capture long term value, it needs to internalise origination capabilities or build strong (institutional) relationships to own the distribution. The stand-out winner might do both.

- Distributing formerly inaccessible assets presents another strong value proposition for both supply (enjoy more liquidity) and demand (more flexibility and diversification). There are many asset classes that fit this theme, including real estate, private equity, corporate bonds, green energy infrastructure, carbon assets and other ‘alternative’ assets. Any physical or financial asset could be tokenized, hence the list of options is endless. One can think of this opportunity as ‘technology-enabled SPVs’ or ‘Vauban 2.0.’. Because of tokenization, it becomes easier to build the trading infrastructure for secondaries and introduce a marketplace across various asset classes. Again, the full-stack approach allows the innovator to earn both minting and trading fees. Distribution via private banks could be a smart way to generate early interest as their clients have a strong appetite for alternative assets. Finally, as the demand side for this opportunity is highly diverse, including a large number of small investors new to the world of blockchain, the interface should abstract away the complexities of interacting with blockchain.

- As an exception to the rule, I believe middleware providers who target large financial institutions could also capture significant value in the years to come. The ‘interim period’ will take longer as these institutions are highly risk averse and adopt new technologies more gradually. They will establish focus groups and conduct numerous pilots before running on-chain operations at scale. Because these institutions carry a lot of legacy infrastructure, the middleware provider also becomes responsible for building connections between the different systems they operate on.

There are also a number of other interesting developments important to the institutionalisation of DeFi, like on-chain identity and on-chain credit scoring. I did not cover these trends in this article, but you can find some relevant reads here and here.

Despite innovation taking time, we are clearly approaching an inflection point in the adoption of on-chain finance. We will not change the financial plumbing of our financial system overnight, but I am more optimistic than ever that today is the right time to invest. I am keen to speak to anyone building and/or investing in this space. Please get in touch using the contact form here.

Source: the excellent RWA primer of Raysdale, Chong, and Venkatakrishnan

Thanks to all the founders I met working in the field of on-chain finance. Special thanks to Jasper De Maere, Matt Ong, Michiel Lescrauwaet, Philipp Pieper, Timo Lehes and Tze Donn Ng for in-depth discussions and comments on the article.